Only 8 months ago were we discussing the boom of real estate in the metaverse and its bright shiny future. Snoop Dogg replicated his Californian mansion by creating a 144-parcel paradise and we saw a record setting purchase of $450,000 for a 9-parcel property next door. However, the rocky state of the world economy has sent ripples into the digital world with the likes of Decentraland and Sandbox experiencing their first real price crash.

Only 8 months ago were we discussing the boom of real estate in the metaverse and its bright shiny future. Snoop Dogg replicated his Californian mansion by creating a 144-parcel paradise and we saw a record setting purchase of $450,000 for a 9-parcel property next door. However, the rocky state of the world economy has sent ripples into the digital world with the likes of Decentraland and Sandbox experiencing their first real price crash.

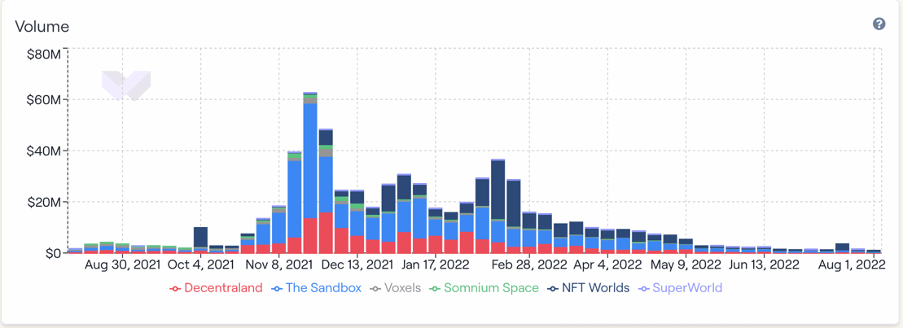

Looking at data provided by WeMeta we can see a continuous drop since Feb 22 with prices down 85% and purchase volume falling off a cliff. Virtual land previously bought is now worth next to nothing of its original sale price. The record-breaking purchase of $450,000 could be worth barley $30,000 at the moment. Cryptocurrencies such as ETH and BTC, used to purchase virtual property, are at half the value of their all-time high and this is reflecting in the price drops. Average price of land sold across Decentraland peaked at $37,238 in Feb 22. But as of Aug. 1, costs dropped to an average of $5,163. Sandbox followed the same trend with average sale price dipping from $35,500 in Jan to around $2,800 in August.

While the factors influencing Crypto fluctuations are taking their toll, the biggest issue, one intrinsically linked with the very success of the metaverse, comes down to popularity and traffic. If people aren’t using the metaverse and interacting in the virtual spaces, then the spaces themselves don’t hold much value. “It’s an attention economy. People are interested in having the land in places with a lot of foot traffic,” says Mitchell Goldberg, University of Basel, “But, if the attention for the whole world decreases, then the prices for all of these land parcels will decrease.”

Another issue undoubtably having an effect is the value virtual land holds in an unlimited digital world. Should some sort of limit be introduced to make the space practical and provide a centralised social experience rather than enabling thousands of virtual miles of space? While new metaverse land can always be created, companies can’t manufacture the attention.

So what of the future? The concept of the metaverse is the natural evolution of the web. Users are looking for more immersive experiences and virtual real estate provides new possibilities. Buildings that take on new creative forms that stretch the imagination could provide reference points and familiar spaces for users to meet and interact. These same spaces could have multiple uses and switch between homes, venues, nightclubs etc. Future potential for brands within this space is huge. Digital headquarters, events and commerce could all result in a new wave of influence and brand building.

Despite recent crashes the projected metaverse value is still near on $1.6 billion by 2030. Tomas Nascisonis, CEO of Crypto House Capital states, “Metaverse land prices have fallen recently. However, economic factors are temporary, the metaverse of the future will still grow.” Could this recent crash provide the perfect opportunity to snap up land at a fraction of its potential price? It is early to tell and the metaverse is only just gaining momentum. Will this be the long-term investment everyone hopes it will be? Time will tell.

**Graphs sourced from WeMeta