Central London overview

As expected, as a continuation of qtr. 2, the advancement of economic uncertainty appears to be gathering momentum, and although the deal numbers are not supporting a correction (yet), the whispers and murmurs within all sectors is loud enough for everyone to hear. For now, it is worth noting that the legacy transactions continue to move towards completion, as well as the continued take up of prime space in the core markets throughout London. On the face of it this is positive, but with the various negative influences gathering pace, the dominating word that never seems far away, but certainly never missed is ‘uncertainty’. Alongside which, more deals seem to be floundering, particularly as decision makers ponder not how they are going to support growth, but how in fact they are going to baton down the hatches for the oncoming storm.

Beyond this, the nervous energy is coming through occupiers in various forms of cost cutting. This is currently making its way through internal analysis of the costs associated with offices, business associated contracts, and of course staff. As a result, we are already seeing a steady increase in the amount of tenant space coming to the market, and unlike previous downturns, the quality is largely very high, and as a result, we expect to see a period of misleading activity, as occupiers take advantage of financially distressed disposal liabilities; mainly in the form of assignments, sub leases and less frequently, surrender and re-grants. Whilst those disposing have some money to pay away the liabilities, there is opportunity. Unfortunately, when inevitably these war chest facilities begin to dry up, mitigating lease liabilities will become extremely difficult.

Market rents

Take-up figures for 2022 to date continue to contradict wider market uncertainty, as transaction levels in Q3 are above the 10 -year quarterly average for the second successive period. Demand for prime stock is undimmed in the year-to-date, with 65% of all transactional activity focused on Grade A quality product.

Despite the current economic headwinds, rental levels for premium space are continuing to achieve levels well above the wider submarket averages. The average rent achieved for transactions over £100 psf in 2021 as a whole was £117.50 psf, but for Q3 2022 that figure has risen to £125.50 psf. Concern remains over secondary pricing though, with significant lack of traction for second hand, recycled stock which fails to meet market standards for sustainability and flexibility. We are still generally seeing occupiers wanting the highest quality space they can work with within budget as a ploy to attract more members of staff to the office more days a week.

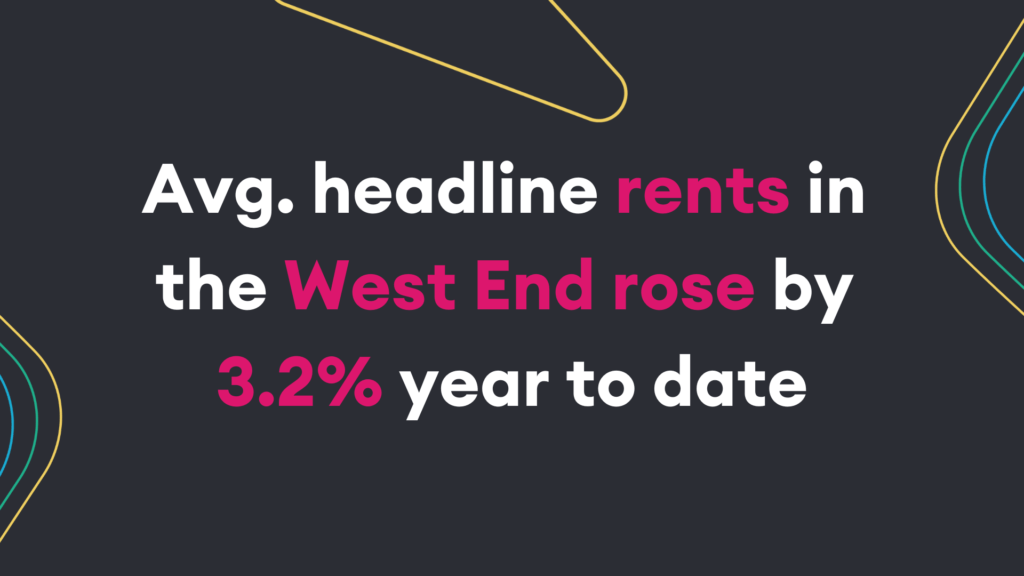

In the West End, transaction levels have exceeded the 10-year quarterly average in four out of the past five periods with Q3 numbers at 35% above the long-term trend. This was achieved with only one letting over 50,000 sq. ft, that being the 225,000 sq. ft pre-let to Blackstone at Lansdowne House, W1. This underlines healthy demand across all size bands. Demand for newly built refurbished products surged to a 12-month high and was the second highest quarterly total since the start of 2019. Prime rents have seen further upward movement. Average headline rents in the West End rose by 3.2% year to date, with Fitzrovia, Mayfair, St James’s and Soho all in excess of that figure.

In the City, Q3 figures were demonstrative of a city market where transactional activity remains above the 10-year average, but vacancies continue to rise – especially in fringe locations such as Shoreditch. Churn of second-hand space, while remaining consistent over the past 12 months with a quarterly average of 1.1 million sq. ft of second-hand letting activity, is still failing to keep pace with supply of newly marketed space, hence rises in wider vacancy numbers. Headline rents remain at £72.50 psf and while there is evidence of rentals above £80 psf, these were all for upper floors in high profile schemes or sub 10,000 sq. ft units. Given the expanding oversupply of secondary accommodation, downward pressure on average rents is expected over the next six months, regardless of uplift at the premium end of the market.

Leasing activity

Since the removal of all Covid restrictions, we have seen a growing confidence in returning to offices, perhaps on a more flexible basis compared to the years prior. This has further helped employers to re-appreciate / justify the fundamental need for an office, and as a result, as mentioned prior, London has seen a significant drop in second-hand tenant space availability in 2022.

Q3 2022 has been the most active of all the quarters this year-to-date, with many occupiers committing to their office needs despite increasingly uncertain external factors such as rising inflation, poor government leadership and a continued fall out from Covid and Brexit. The technology, media and law industries continue to drive the demand, especially at the larger end of requirements.

As well as Blackstone at Lansdowne House, there was another large pre-let of 104,700 sq. ft to Addleshaw Goddard at 41 Lothbury. This underlines the boldness for occupiers to acquire high quality buildings to future proof their property plans. There were four additional deals in Q3, all larger than 50,000 sq. ft.

The West End continues to be the Central London’s best performer, with Q3 take up totalling 1.3 million sq. ft. The Docklands also saw an increase in take up in Q3 circa, 241,100 sq. ft which is circa 30% above the 10-year average, led by a significant letting at 40 Bank Street to Citibank of circa 95,000 sq. ft. Take up in the City was circa 850,000 sq. ft in Q3, which remains circa 35% below the 10-year average.

According to CoStar, deposit net absorption being positive over the last 12 months, vacancy has continued to rise, and delivery of new assets outweigh demand. So much so, London’s vacancy rates now stand at 8%, which is a 15-year high. We expect this to rise even further over the next 18 months as more supply will be delivered to the market.

Overall, however, the market remains in a state of flux. Best in class, often fitted offices are continuously sought after. With the poorer, Grade B office accommodation far less desirable. Furthermore, despite this drop in availability levels post a resurgence of people returning to the office, availability remains 50% higher than it was in pre-pandemic years.

Vacancy rates and availability

Vacancy rates are still exceeding the 10-year average but continuing to stabilise in London due to an increase in take up. Trends are beginning to emerge from key submarkets which could be a sign of things to come.

We saw a reduction in availability in the West End compared to the previous year with an average vacancy rate of 5.9% with overall supply being just under 7 million sq. ft. Average take-up in the west end markets also illustrated an increase in comparison to the previous year, exceeding it by approximately 650,000 sq. ft. July 22 saw the highest take up across the west end markets with 1.01 million sq. ft of space being acquired. The Core West End continues to exceed records due to supply being limited. Headline rents across grade A and B continue to rise and Mayfair has its lowest Vacancy Rate since Q4 2019 at 4.3%.

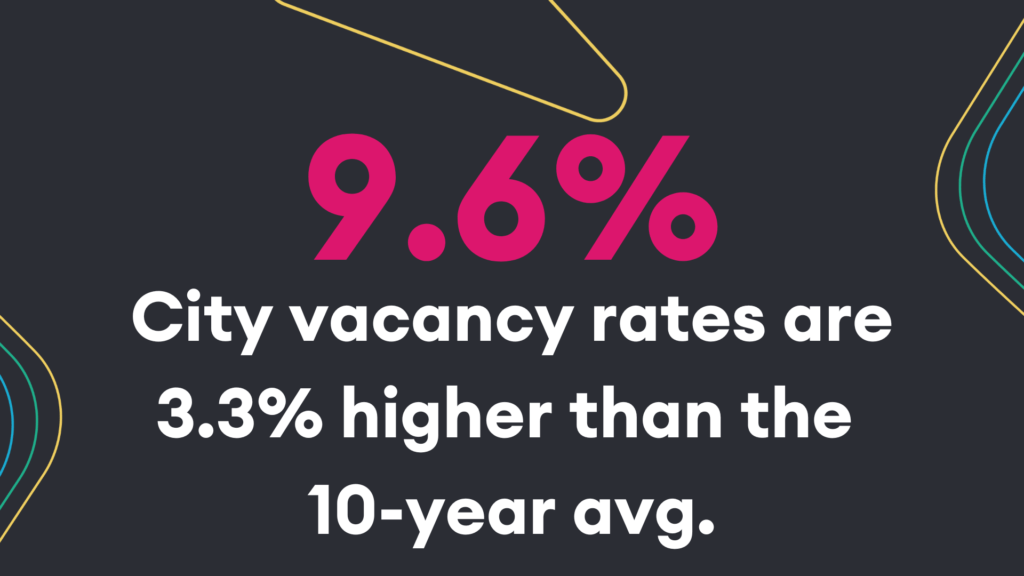

It is predicted that tenant-controlled space will start to increase across all markets due to volatility in the economy and the increase in costs across the board – interest rates, inflation, construction work, energy and service charges to name a few. This was evident in the City Markets as there was an increase of approximately 590,000 sq. ft. of space put onto the market, with just under 40% of this being tenant-controlled stock. The vacancy rate within the City Markets stood at 9.6% which is up 3.3% from the 10-year average. It will be interesting to see how increased tenant stock impacts the growth of the Grade A and CAT A+ market following number 10’s honest appraisal of the state of the economy.

Sales market

The first thing to say is that Q3 2022 has seen the worst performing quarter for two years. The reasons for this are down to the cost of financing and debt increasing due to the Governments recent poor handling of trying to reduce inflation. With uncertainty over how the BoE is going to have to increase interest rates in the coming months, most properties that were put on the market in the last 3-6 months have seen weakening demand for those products and weakening prices. Evidence of this was earlier this year 21 Moorfields which is wholly occupied by Deutsche Bank was rumoured to be commanding a hefty £1bn price tag however Lendlease have agreed to a price of £809m, albeit its last valuation was 9% higher than the price agreed. No doubt we will start to see further reductions in capital values and over time we will also see yields start to soften as well, albeit with the Pound Sterling shedding its value to most other currencies around the world, we may see further foreign investment come into the market where buyers think they can snaffle some good assets at lower prices…however they may just wait a bit longer to see how things play out before doing so, meaning that a further sitting on hands will stagnate the market further.

As most property professionals will know, there has been a lot of freehold investments that have hit the market in Q3 2022 however it does feel as if this has been a knee jerk reaction to the economic turmoil with many owners feeling they want to get out while they can before the market takes a serious downturn, however the fear is that they have left it too late and missed the boat. We shall see!

Development pipeline

The cost of building new schemes has gone up significantly over the last 12-18 months as we know because of supply chains being squeezed due to the pandemic and Brexit, forcing many developers to look more closely at whether their intended schemes are going to be fiscally viable or not. With uncertainty over how the market will react to various tough market factors/conditions over the coming months/years, landlords will be trying desperately to work out what kind of rents they will be getting when their schemes complete and how long they are likely to have to wait for tenants.

Over the last few years, landlords have found that occupiers with large footprints were increasingly looking at pre-lets to satisfy their needs, however with demand waning in the last few months, it is not easy to predict whether large schemes will have the same kind of success on pre-lets going forward. One thing to note is that there are a number of larger occupiers (mainly law firms) out in the market carrying out feasibility studies on several potential 100k+ sq. ft requirements so landlords may be buoyed by this news.

What is important for the supply and demand of office space generally is that in 2023 there will be a record number of completions of both new developments and refurbishments including 40 Leadenhall Street (870,000 sq. ft), 20 Ropemaker Street (425,000 sq. ft) and Millennium Bridge House (292,000 sq. ft). This will increase supply and potentially at a time when we start to see more space come onto the market due to occupiers reducing their footprint, potential defaults due to businesses struggling as well as weakened demand. Should be interesting to see how this all plays out.

Industry analysis

It felt like Q3 was finally the turning point towards the looming recession with the markets finally bowing to the pressure around them with inflation continuing to rise, negative returns coming from shares & bonds, increase in interest rates and a new Prime Minister. We closed off the quarter with the Mini-Budget which didn’t go down too well and caused the pound to plummet.

Most areas and sectors were already in decline before the budget was announced and we’d anticipate Q4 being a lot worse than what we are reviewing here in Q3. Fears from the general public around the rising costs of household bills naturally slowed House Builders, Retailers and the Travel & Tourism sectors who had all made superb comebacks following the lifting of restrictions post-covid. What we can expect in Q4/Q1 and beyond is that those fears now become reality, with an approximated 2 million people on variable rate mortgages and many more coming to the end of fixed terms, this will have a further impact on the aforementioned sectors as well as impacting many others.

The unemployment rate actually decreased by 0.3% during the quarter, and reports from the likes of CIPD suggest that employment confidence remains high, with private sector pay at a new peak. Will Q4 be the turning point now the real-life strains of the last few years are taking effect and hitting people’s pockets? We have already seen the first announcements of redundancies in our own sector, with the big green machine, CBRE announcing a $400 million cost-reduction plan.

Looking at the private equity and VC investments over the quarter, we have seen the first decline since the beginning of the pandemic. Both deal volume and the amounts of money raised decreased and MegaDeals (£50m+ investment secured) hit their lowest levels in two years. Popular sectors for funding rounds over the last couple of years such as life sciences and Fintech fell by 43% and 33% respectively. Having said that, Fintech continued to lead the way for the number of announced deals, followed by AI and then CleanTech, a sector who secured half of the MegaDeals completed in the quarter.

Flexible workspace

Q3 saw very little movement in real terms of desk rates across both the City and West End markets, despite the added pressure put on serviced providers with energy costs. Dialogue has started though about how that cost is best shared with occupiers without increasing desk rates beyond their current benchmarks. Occupiers who decide to make longer-term decisions now, on fixed rates, will undoubtedly benefit should the cost of energy increases continue its current trend.

Acquisition activity was relatively sporadic across markets with no one player reporting a steady influx of new occupiers. September often presents itself as one of the busiest months in the flexible office sector however, it seemingly started slowly this year but a strong end to the month and quarter meant it kept its stereotypical stance as an important period for decisions being made.

One of the biggest challenges facing occupiers and serviced providers in the West End in Q3 was availability. The West End has had an extremely robust return post-Covid which has resulted in reduced opportunities for occupiers. The solution to this issue seems to be a small migration to Midtown with a number of new flex options due to open in Q4 and with a healthy amount of quality buildings already there, we expect that will be the place to be in Q4 and Q1 2023.

The City continued to rebound but at a much slower pace than other markets across London. With extremely competitive rates available we’re seeing occupiers become more confident in the area and expect it to keep up its steady return. This slower return though will likely protect the desk rates spiking rapidly as serviced providers remain as agile as possible to attract new business and improve their occupancy.

The roundup

In property circles, often there is a marginal obsession with not talking the market down. There are occasions where this is a point fairly made, however, in other circumstances there is benefit to some realistic views, both on the current market, as well as the outlook going forward.

The Current Climate

Within the UK, the economic and social storm clouds have been building for quite some time, and one could argue that we have all been supressing the largely feared ‘great correction’ since as far back as the Banking Crisis. This is the concept of the loosely used term of ‘printing money’, and at that time it was via ‘Quantitative Easing’. Then moving on to the pandemic, through ‘Furlough’, as well as ‘Stamp Duty Holidays’, and various others forms of un-natural financial intervention. Ignoring the clear and deep financial complexities, the net result leads us to the current day, where we have very few assistance options available, and the power of these multiple supressed negative forces needs to be realised. Pretty scary stuff, and this is further compounded by a multitude of other negative forces, all culminating at the exact same time.

If we look at some of the major events that have occurred since the publication of the last published SHB report (qtr 2):

- -We have quickly moved onto our 3rd prime minister

-Her Royal Highness The Queen has sadly passed away;

-Inflation has continued to rise, and now sits at over 10% with little sign of stopping

-The pound has periodically gone into free fall

-Interest rates continue to rise, with further rises anticipated. Furthermore, both residential and commercial lenders have taken interest rates into their own hands;

-The war in Ukraine continues, and although it may not be as prevalent in the UK press, but it has been raging, tragically with horrendous physical and financial tremors being felt both at home and abroad, not to mention the disconcerting use of language connected to the usage of the Russian nuclear arsenal.

All pretty grim, but on the bright side, lease events will still continue to come round and happen. Actually, in the short term, the SHB expectation is that we will see a period of significant activity, as tenants become defensive and re-establish their commercial occupation. Furthermore, with the uncertainty, we are likely to see further success within the serviced markets, but what is the future for serviced and managed solutions? Extremely difficult to say, so we can watch and learn for now on this front. What is clear is that the fast-approaching correction is going to be one hell of a ride. For now, let’s keep a watchful eye on rising unemployment, companies hitting the wall, and a special look out for that special something to really light the recessional fuse.