Central London overview

The last quarter of 2022 was largely about whether the UK economy was in recession or not. It appears that by the skin of our teeth we have technically just avoided it, however throughout this period, the broader economic landscape has been continuing down a rabbit hole of major negativity. It really is a cocktail of bleak circumstances, as individual influences might indeed be manageable, but as a whole it is making positive trends increasingly difficult to come by. In fact other than certain parts of the core West End, and some very specific buildings of high calibre, the trends are slowly moving away from Landlords and tipping into the Tenant’s favour.

Across London and the wider UK commercial office markets, vacancy rates and letting voids are stretching out. The lease lengths are largely standing firm for the very best space, but flexibility is a key message delivered by occupiers to most landlords. Amongst the various reasons for this, there is generally more competition than ever from the serviced market, and this is forcing most Landlords to be more competitive than perhaps history would suggest.

When it comes to rents, they are starting to feel the pinch, and throughout the year the periphery and/or emerging markets have been creaking, however now we are seeing a clear reverse in rental profiles for anything that is not grade A. This is being further supported by the increasing flow of second hand space (largely of very good quality) that is available at a pinch (subject to the dreaded Landlord’s consent), compared to the space directly available from the landlord.

With all of the above in mind, there are deals happening, but they really dropped off in the final months of the year. Often when there is a slow down or pause like this, something of greater importance has taken the place of that priority position. The declaration of hiring freezes amongst many corporate entities combined with the whispers of rising redundancies and weakening company accounts, may determine the next phase of this downturn, but let’s not be surprised if the lack of activity in the last quarter of 2022, results in a spike of initial activity in 2023.

Market Rents

Take-up figures for 2022 returned to a level above the long-term average for the first time since the onset of the pandemic, reaching 12.5 million sq. ft. While November GDP was marginally positive (+0/.1%), economic uncertainty remains to the fore and while Q4 transaction levels were in line with the 10-year average, they represented the lowest level since Q1 2022. Regardless, numbers for 2022 were 22% up y-o-y and over double in 2020.

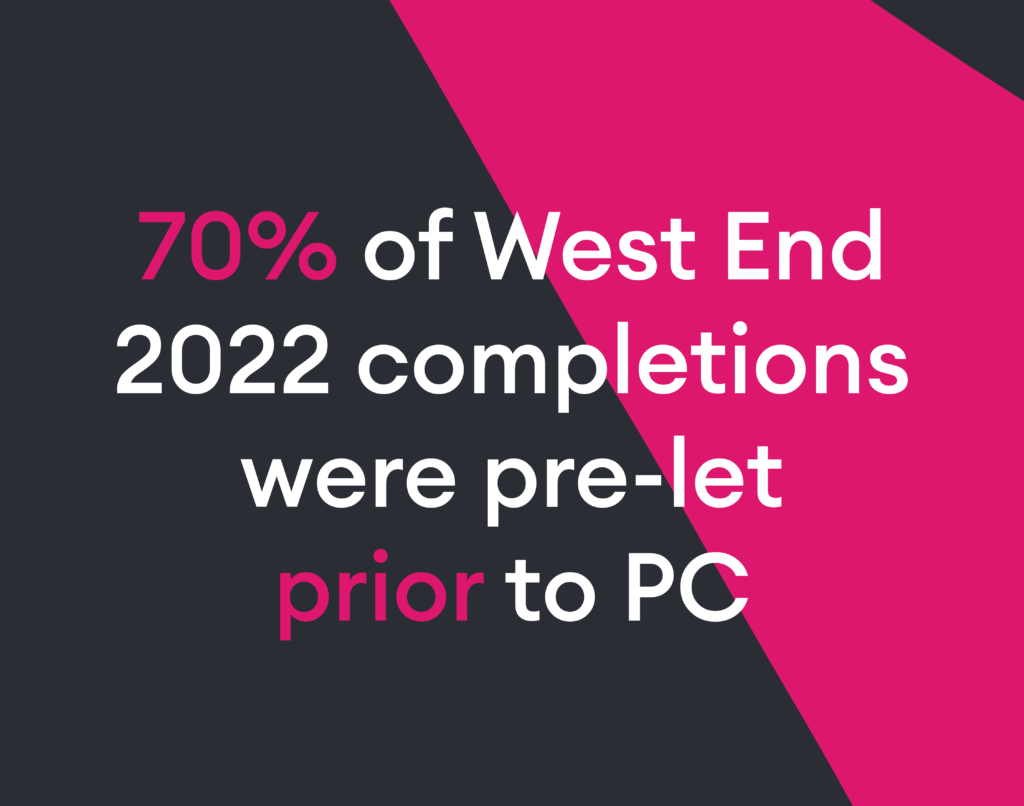

Pre-letting activity surged in 2022 with close to 3 million sq. ft of transactions, approaching a 100% increase from 2021. Major new HQ commitments in Q4 by Clifford Chance, Reed Smith and Lazard boosted end-of-year take-up. Pent-up demand from the legal and professional services sector has provided a major stimulus to transaction levels.

There is clear evidence of a multi-tiered market in terms of rental levels – as shown in the SHB Q4 market rents and rates guide. Premium/prime is extremely buoyant with top rents seeing upward pressure in most of the submarkets. Un-furnished second-hand space still makes up the majority of the market with rents remaining depressed, although appetite for fitted space, negating capital outlay, is still strong.

West End submarkets continue to see upward movement in prime rents. Average prime rental growth across all West End submarkets in 2022 was 3.5%, with a number including Mayfair (8.3%), Paddington (6.5%), St James’s (6.3%) and Fitzrovia (5.9%) above that.

While the City’s prime rents ended the year at £72.50 p/sq. ft., unmoved from 12 months ago. Premium rents continue to be achieved on upper floors at high profile schemes. £93 p/sq. ft. was achieved in a letting to Winston and Strawn on the 33rd floor at 100 Bishopsgate and £93.50 p/sq. ft. at 22 Bishopsgate on the Pt 43rd floor to Fidelis.

Leasing activity

While the overall facts and figures behind 2022s activity are far more encouraging when compared to the previous years, according to leading sources there has been circa 20% increase year on year, which is a significant improvement.

It’s important not to get too ahead of ourselves – available space is about 50% higher than pre pandemic levels. London’s office vacancy rate stands at 7.8%, a 15-year high.

It’s clear that there remains growing concern surrounding external factors which continues to plague the London property market. With increasing economic and political uncertainty throughout the later parts of the year. This does little for market confidence, both nationally and internationally.

Despite this ongoing doom and gloom since the emergence of COVID, we expect to see rent levels to sustain within the early parts of 2023, particularly for prime, sought after units. Often landlord, fully fitted accommodation with a big push for greater amenities as occupier, continue to strike a balance between an agile working environment. This is largely driven by inflation and lack of top-quality assets. Examples of this can be found in Mayfair’s Berkeley Square, and in the City’s Leadenhall Building since the Pandemic began. This can be compared to the 2nd hand market, where office rents have continued to slow over previous years.

To put this into perspective, the pre letting market is currently at a 25-year high. With many occupiers, looking to overcome any soon to be EPC changes within the coming years. The emphasis, especially for larger occupiers continues to be on premium, environmentally aware buildings/leases. This upgrading in space, is a tool used to attract staff, even if occupiers on the whole, look to less space when compared to pre-pandemic levels. Law Firm, Clifford Chance, will share half of their office space, following their 328,000 sq. ft. pre letting in the city in a bellwether deal in November 2022.

In terms of take up by type of occupier – activity has been dominated by the banking & finance sector, which represents more than 25% of take-up, and the professional services sector, which accounts for 24% of annual volumes. Contrary to previous quarters, TMT firms represented just 17%, which is down to at least a 10% drop compared to previous years.

As we look forward, submarkets in the City and other fringe locations, including Docklands core and Canary Wharf will incur the greatest rental loses whilst seeing the largest increases in availability. The core submarkets within the West End are likely to perform best, due to their lower vacancy rates and their popularity with a variety of occupiers, most notably the financials, who tend to have a more bullish view of economic uncertainty.

Vacancy rates and availability

Vacancy rates are continuing to rise for another quarter to 8% and have increased by a further 2.4% from 3% to 5.4% on the ten-year average. This is a result of increased new space stock across the city and the completion of new developments such as Arbour, Bankside, SE1. It should be noted that there is over 60% of total availability that is Grade B stock which is in correlation with the last downturn. Overall vacancies across all specifications now exceed the peak during the crash and the last global recession.

Despite the increased availability, there is a distinct lack of good quality stock throughout the West End and City markets. With the flight to good quality continuing, this is seeing continued rental growth of 10.6% over the average. This is further evidence that supports that there is a two-tier market and the disparity between Grade A and B space.

Sales Market

After the infamous Truss-economics debacle which saw the last piece of confidence in the government get thrown into the bin, the resulting uncertainty for the UK meant many investors pulled the plug on any potential purchases they had in their pipeline with estimates of over £1.5bn worth of deals get side-lined. With inflation rising and the Bank of England looking to steady the ship with interest rate rises in Q4 2022, the cost of debt rose as a result, and this meant investment agents spent most of the quarter licking their wounds as figures now show Q4 2022 was the worst quarter in the last 20 years. Just £500m worth of deals transacted in the quarter compared with £6.4bn in Q1 2022 – quite the downfall. The most notable of those deals this quarter was the sale of Holborn Gate outside Chancery Lane tube for £160m.

With the above being said, the pipeline for the new year seems to be a lot rosier, however we await to see whether Rishi Sunak has managed to rebuild confidence in the market.

Development pipeline

The main theme of the redevelopment and refurbishment pipeline for Q4 2022 was that of delays to completion due to shortage of materials and the ongoing supply chain issues that many developers and landlords have been experiencing since the Ukraine crisis. The end of the year has confirmed that close to 13m sq. ft. of new or refurbished space has been started with 2.5m sq. ft. of that brand new space, this is just over the 10-year average.

The legal sector has been the main beneficiary of these projects taking up 33% of pre-lets. Most of the new stock is just replenishing existing strong submarkets like the West End and the City, whereas outlying areas (Stratford, Nine Elms, White City), which were previously doing well in terms of new developments have seen a significant lack of activity in recent months.

With this number of delayed completions in 2022, it means that 2023 will see a significant amount of brand new and newly refurbished stock hit the market. Given the rising costs of developments due to the fall out described earlier, we expect to see 2024 and 2025 relatively subdued compared with the pipeline for 2023, with further stock hitting the market in 2026 after green lights have been given on some schemes from planning departments.

Landlords are increasingly looking at sustainability, EPC pressures and carbon efficient developments as their buzzwords going forward, but this all has cost pressures which can’t be avoided in today’s climate. However, they will be buoyed by the ‘flight to quality’ tagline being mentioned these days as occupiers work out how they can get their staff back to the office.

Industry analysis

Following a pretty disastrous Q3, the final quarter of the year really showed all the signs of us dipping into recession, however, the economy remained stagnant which was mainly due to reshuffles & U-turns in parliament with Jeremy Hunt reversing policies announced in the ‘mini budget’ and providing some much-needed stability to the markets.

We did, however, start to see the negatives take effect on the job market with the percentages of businesses recruiting dropping from 84% in Q3 down to 78% in Q4 and 16% pausing their recruitment with the economy threatening growth plans. We saw more talks of lay-offs, having mentioned the huge cuts from the big firms in our own space in the previous quarter, this continued and spread across mainly the TMT sector with that trend set to continue in to 2023.

Flexible workspace

An off-trend December capped off an unpredictable 2022. With lots of uncertainty in the final quarter of the year, December proved to be a positive end to an up-and-down 12 months where we saw a high number of transactions in the final few weeks of 2022.

October and November were uncharacteristically quiet, as companies delayed on making decisions on their future. However, this resulted in a strong December as the future of energy prices and the political landscape became clearer.

The West End and Midtown remained popular destinations for companies, but limited availability still hampered more transactions happening in these areas. As a result of the lack of availability, prices remained stable in these markets with very few promotions on offer. The city continues to lag, however, we did see an uptick in requirements for the Square Mile and its fringes. This is a trend we expect to see continue into Q1 of 2023 with new buildings opening and a more competitive market for the company seeking more space for their money.

As businesses continue to try and entice their staff back into the office more often, we’re seeing occupiers seek mid to up-market stock rather than look at the lower end of the market. We don’t anticipate this changing and, as a result, we expect the more cost-effective office providers to become more creative with their offering to compete in an ever-growing flex market.

There was limited activity in the AIM with only 2 IPO’s and just 9 across the main market. In the world of private equity and venture capital, the number of deals increased ever so slightly in Q4 up by just 5 deals from the previous quarter. Most high-growth tech sectors had a fall in deals over the year with AI, Fintech, Life Sciences and Digital Security all in decline. Even so, Fintech still took the top spot with a total of 305 announced deals in 2022. The two best performing sectors who saw an increase in deal numbers over the year were Blockchain and Cleantech, which we imagine will continue to go from strength to strength over the coming year.

A roundup from SHB’s CEO

With 2022 coming to a close, during which SHB incredibly turned 10 years old, it was a real chance to reflect on the SHB journey, in particular the events of the past year.

As has become normal, every 12 months feels like the SHB business evolves completely differently in many ways. In this year we grew to a company of 22, moved offices from Soho (Newburgh St) to Covent Garden (Floral St), upgraded our brand, developed & upgraded multiple technology platforms, lost some things, won more things, built a furniture business (Pattrn Workspace – Launching Feb 2023) and more. It’s been a busy time.

Changing the attention to the wider market, where the economic climate appears to be more uncertain now than I can personally remember, the negative influences are wide and varied with inflation still raging, interest rates rising to more historically normal levels, the war in Ukraine apparently building further momentum, continued fall out from BREXIT, the ‘Cost of Living Crisis’ and more. Let’s be honest, it makes for depressing reading and depending on everyone’s personal circumstances, these are the ingredients for some tricky times. Despite the doom and gloom merchant media, pretty much most businesses that SHB are talking to are super busy so…

When will we see real negative impact?

Often in Western economics, things take some time to feed through the system. Ultimately people and commercial organisations feeling the pinch need to eat into their reserves, and this is the start of the process. In the UK, we often have a strange response to dangerous markets, in that we tend to spend more. Regardless, we are already seeing some strong signs of negativity throughout London with some rents being squeezed and incentives being pushed out. It would then make sense that these trends will continue to spread with voids and vacancy rates following.

The idea of a catastrophic sudden downturn at the moment, seems unlikely, however nothing should be discounted (remember Lehmans?). In the first few weeks of January the sentiment has been very good, however let’s not be fooled. Things are likely to be very up and down for a while, but in the emerging chaos are opportunities for us all.

For now, let’s be grateful that the success of Grade A space and the strength of Mayfair is enough for the entire market to talk positively about without dampening the mood by chatting about all the negativity surrounding the ‘other stuff’.