Rates, price per square foot – any way you look at it, real estate square feet means cost, and any unused space can be a real downer for your portfolio values.

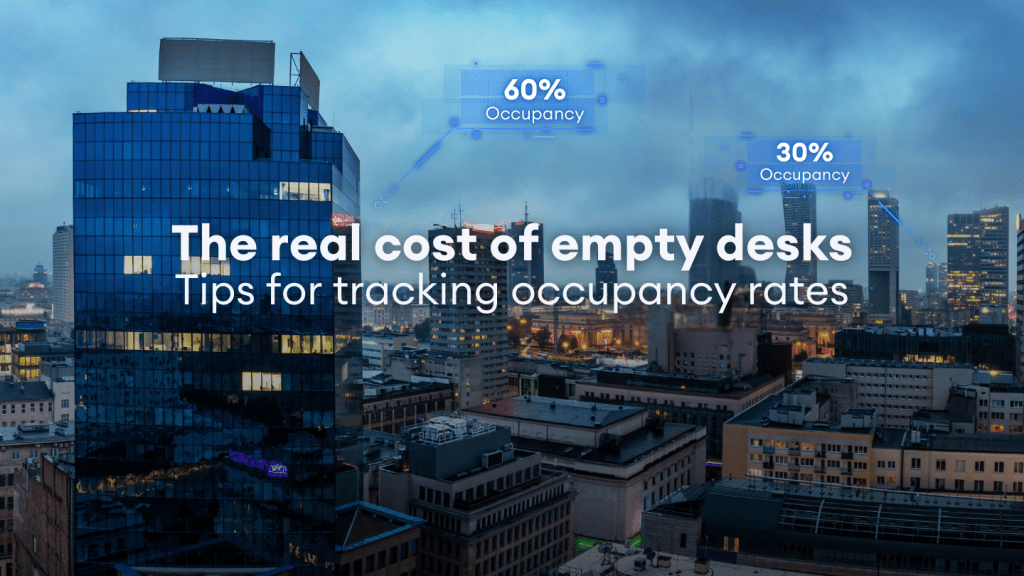

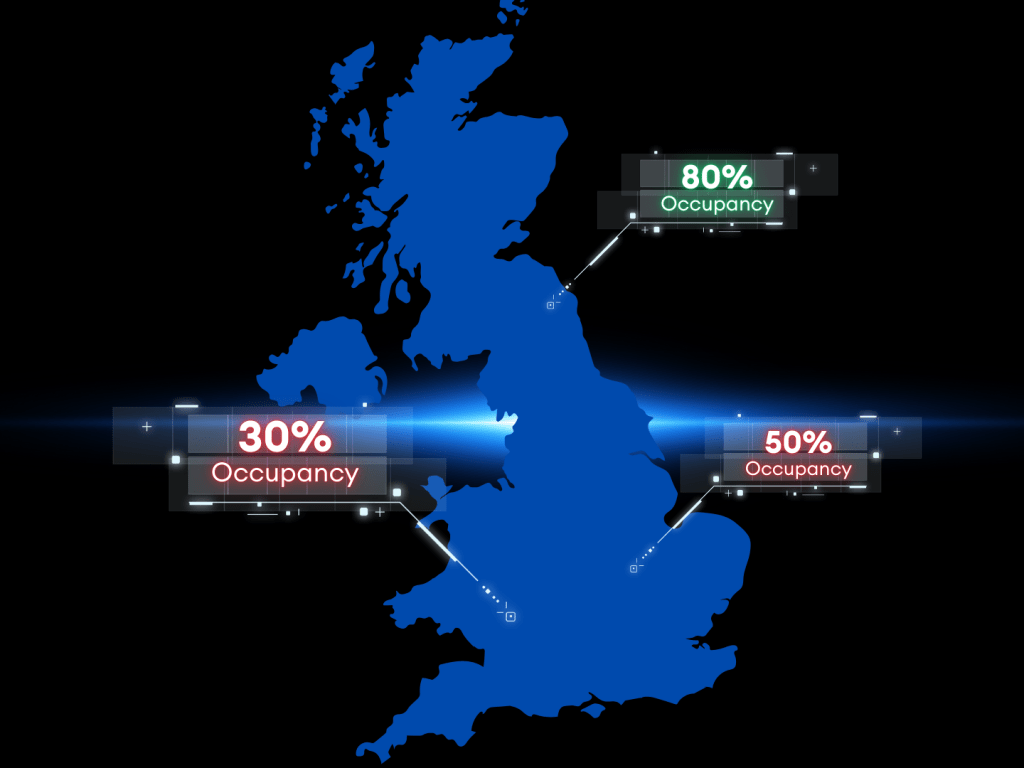

With changing work habits and the rise of hybrid models, the number of people in office buildings often doesn’t match what’s intended in the lease. You might see 90% economic occupancy on paper, but if only 30% of desks are used each day, your real estate portfolio may not be serving you well.

Tracking physical occupancy alongside lease break dates can be a real eye-opener for proactive property planning.

The case for occupancy tracking

Physical occupancy tells you who is actually coming into the office. Unlike economic occupancy, which is based on who pays rent, this data gives you a real-time look at how your space is used.

It can reveal:

→ Underused floors

→ Teams that rarely come in

→ Entire buildings that sit half-empty

When you combine this information with lease break options and termination windows, you gain valuable strategic insights.

Use occupancy data for your lease plan

When you bring together occupancy analytics and lease data, CRE leaders can:

→ Identify excess capacity before a lease auto-renews

→ Consolidate teams into fewer locations

→ Negotiate early exits from underused spaces

→ Delay expansion plans based on actual demand

This approach lets you plan your space proactively, using real data to support your decisions.

Risks of ignoring economic vs. physical occupancy

If you don’t track both physical and economic occupancy, you risk missing important details that could cost your business.

Here’s what’s at stake:

→ Overpaying for empty space

You pay the full cost of leases for areas that aren’t being used.

→ Missed consolidation windows

You might miss lease break options without realising it. We’ve witnessed first-hand just how much this can hurt!

→ Poor forecasting

You could expand when it’s not needed, or even downsize in the wrong place.

→ Inefficient portfolio decisions

Without clear information, your CRE strategy becomes reactive instead of strategic.

What you can do now

1. Look at sensors, badge swipe data or reception logs to track tenants’ movements.

2. List out key dates, lease terms and break clauses for each location.

3. Compare both sets of data to find areas where space is not used efficiently.

4. Build a plan that takes advantage of opportunities to consolidate space as soon as lease events arise.

This straightforward approach helps you regain control and ensures every square foot and every lease works harder for your business. We created TERA Lease Management to help track key lease data such as occupancy levels, upcoming lease events and opportunities to save costs across portfolios. Learn more about that at tera.lease or contact our team for a demo.