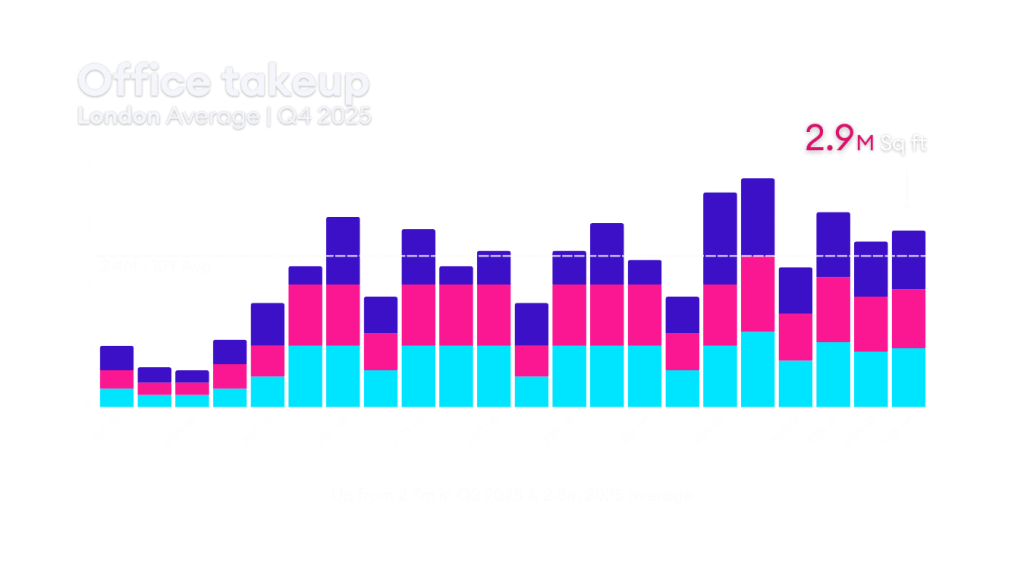

Take-up rebounds as vacancy tightens and availability contracts

Central London office take-up rebounded strongly in Q4 2025, marking a decisive improvement on Q3 activity. Leasing volumes reached 2.9m sq ft, exceeding the long-term quarterly average and signalling businesses committing to their new space.

Large transactions returned to the market, led by financial and professional services occupiers, with the City accounting for over half of total take-up. Pre-let activity also re-emerged following a subdued third quarter, reflecting improved occupier confidence and clearer decision-making.

Below, we break down the key London office market metrics for Q4 2025 and what they mean for commercial occupiers evaluating their office needs.

Skip ahead to what you need:

– Key London market stats »

– London office rents & rates guide »

– Notable Q4 London office deals »

– SHB client results (£5M+ saved – £32.1M in 2025) & sectors we moved »

Read on for the market stats to help support your next office move…

London office market snapshot

Q4 data revealed stronger leasing activity, a notable reduction in available space, and stabilising rental growth following an active year for occupiers.

High-level stats across Central London offices

→ Average take-up: 2.9m sq ft

→ Average vacancy rate: 7.5%

→ Availability: 20.6m sq ft

→ New / refurbished vacancy rate: 5.8%

→ City prime rental growth (YoY): 8.3%

Grade A & refurbished supply still limited

Demand for best-in-class space continued to dominate occupier behaviour. New and refurbished vacancy remained low, with Central London at c.5.8% and the City Core significantly tighter.

Despite development completions in Q4, a high proportion of space under construction is already pre-let or under offer, limiting future Grade A availability and reinforcing competition for prime assets.

What this means

While completions have increased choice at the margin, demand for high-quality, ESG-aligned space continues to outpace supply. This reinforces the growing divide between prime and secondary office stock.

Vacancy rates fall as availability contracted

The average vacancy rate fell to 7.5% in Q4 2025, down sharply from 9.0% in Q3 and below levels seen earlier in the year.

→ improved take-up

→ reduced speculative supply

→ and stronger absorption of existing stock

The market shifted from surplus conditions toward tighter occupational fundamentals, particularly in core submarkets.

London Rents & Business Rates Guide

We’ve gathered up the headline rents and business rates shifts across submarkets and available stock on the market. See how each prime London office market values their Grade A Fitted, Grade B, Managed Offices, Desk Rates and Business Rates in our guide here ↓

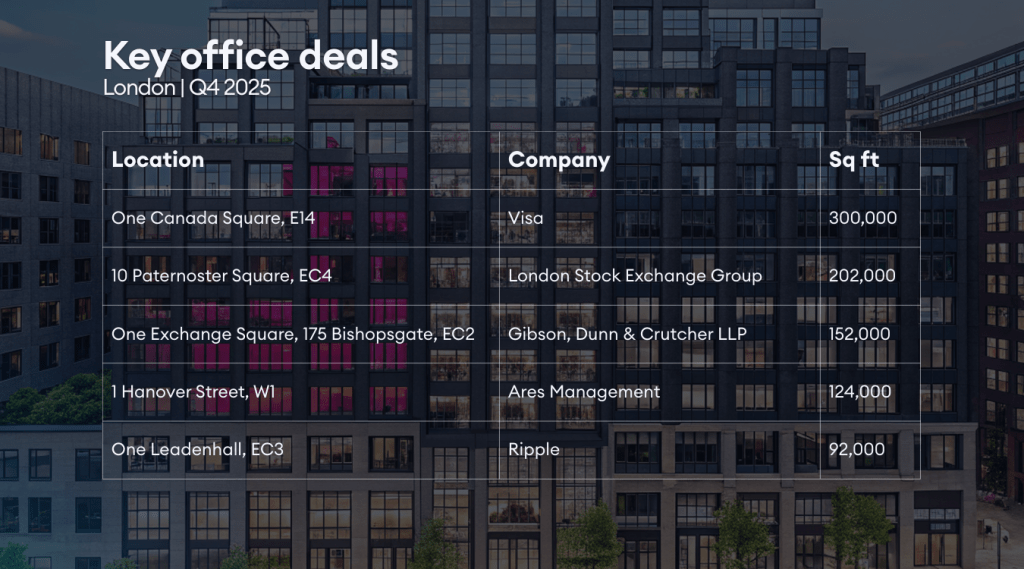

Key London office deals

Taken together, the largest Q4 2025 office deals underline how occupiers are deploying space selectively across distinct submarkets rather than converging on a single “best” location.

Large, operationally complex businesses such as Visa continue to favour Docklands for its ability to deliver scale, infrastructure and value, while regulated and institutional organisations like London Stock Exchange Group and Gibson, Dunn & Crutcher LLP are reinforcing their commitment to the City Core, where proximity, resilience and building quality remain critical.

By contrast, the West End is attracting fewer but highly influential occupiers such as Ares Management, where location functions as a brand and talent statement rather than a pure space solution. The pattern highlights a market that is functionally segmented, with each submarket playing a clearly defined role in occupiers’ long-term location strategies rather than competing on the same terms.

Q4 2025 SHB client results

Money saved & sq ft exchanged

£ saved for clients in last 12 months

desks moved in Q4 2025

1,276 in 2025

£ saved for clients in Q4 2025

sq ft transacted in Q4 2025

629,509 sq ft transacted in 2025

Sectors moving

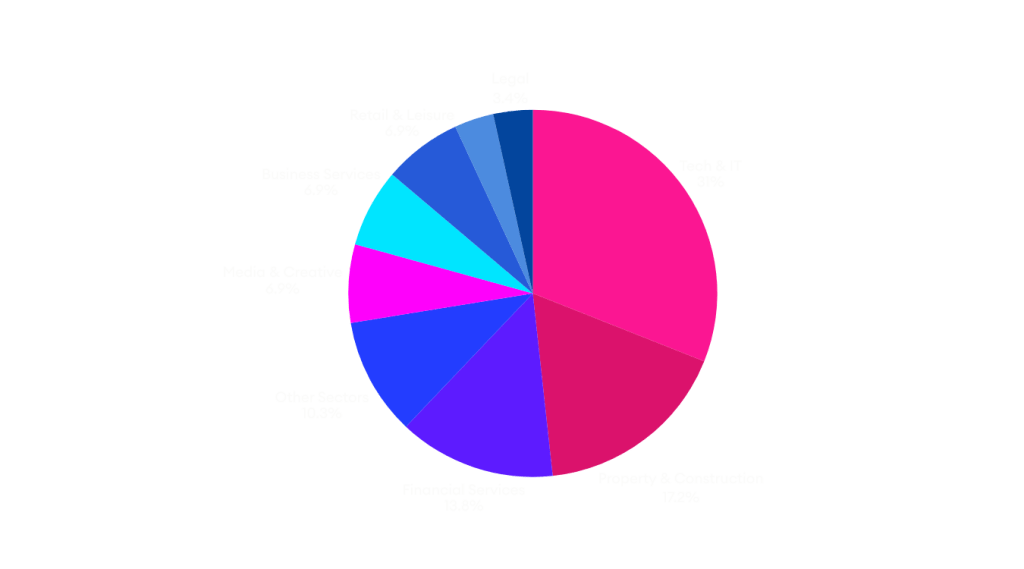

Q4 marked a clear shift in occupier momentum, with fewer sectors dominating activity and decisions becoming more deliberate. Across our SHB workplace advisory, we moved a range of industries. Notable trends were seen in:

Tech & IT led the quarter, accounting for 31% of all deals. This was the sector’s strongest showing of the year and reflects renewed confidence, particularly around relocation into higher-quality, better-located space.

Property & Construction remained consistently active at 17%, underlining steady project-led demand rather than cyclical swings.

Financial Services fell back to 14%, down sharply from earlier quarters, suggesting that much of the sector’s portfolio restructuring had already taken place earlier in 2025 or is waiting for 2026 clarity.

Business Services dropped to 7%, a notable slowdown after a strong mid-year, indicating consolidation rather than expansion.

Media & Creative and Retail & Leisure each represented 7%, showing selective, targeted moves rather than broad-based growth.

More specialist sectors such as Education (3%) and Legal (3%) remained present but peripheral, while healthcare, hospitality and energy-related sectors were largely absent in Q4.

Sectors we found offices for

Office market outlook for 2026

Q4 2025 marked a turning point for the London office market. Rising take-up, falling vacancy and contracting availability all point to improving occupational fundamentals heading into 2026.

However, the market remains highly segmented:

→ prime and refurbished offices continue to outperform

→ while secondary stock faces ongoing pressure

For occupiers, competition for best-in-class space is intensifying. For landlords, asset quality and location remain decisive factors in capturing demand.

If we can help with any office questions, workspace strategy hurdles or opportunities we see in the current market, we are here to help.

Speak to the team +44 020 3514 8867