Results, Sector Take-Up, Rent Trends & Key Deals

The first quarter of 2025 revealed shifting dynamics in the London office market, as occupier preferences and leasing patterns continue to evolve.

Occupiers and investors are gravitating toward high-quality, sustainable space, while older stock sees rising vacancy. Looking back, we’ve seen key trends emerge based on our own acquisition and disposal data, speaking to hundreds of companies and comparing the market stats across London. Here is what we found…

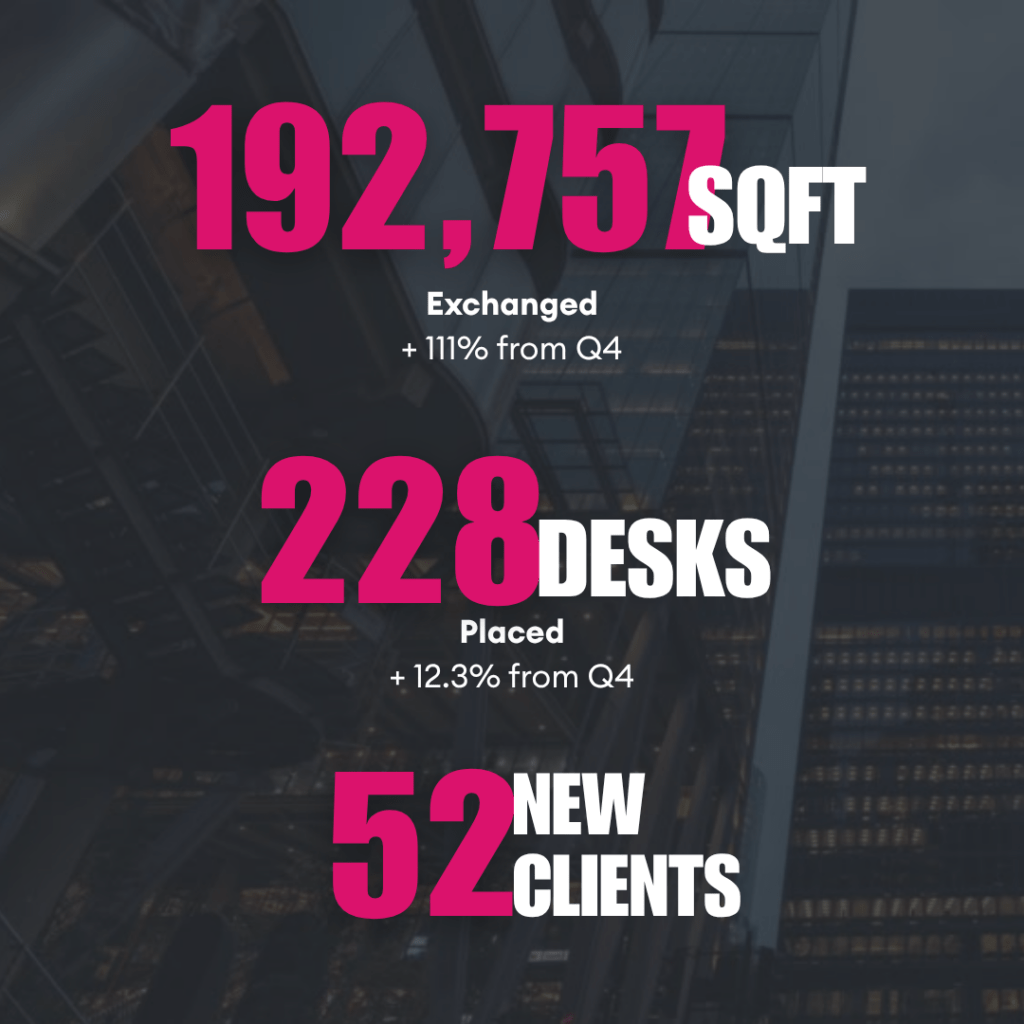

First, some SHB client results

Money saved, operations streamlined & SqFt exchanged

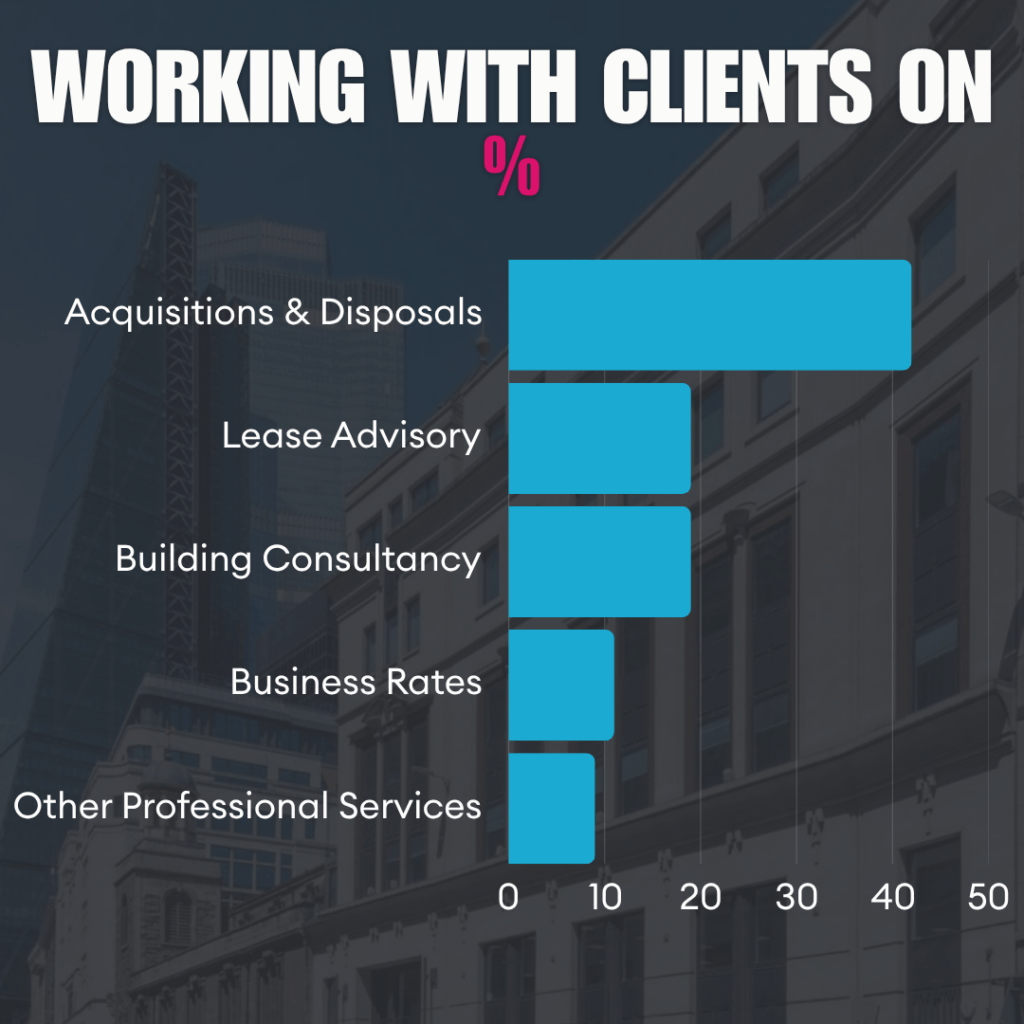

Q1 London Office Sector Take-Up at SHB

Last quarter’s SHB sector take-up saw Banking & Finance maintaining its lead while IT & Services and Property/Real Estate sectors gained momentum. In contrast, TMT & Creative and Professional Services saw a notable dip in activity from Q4 2024, suggesting a more cautious or delayed approach to leasing.

Banking & Finance

Remains a dominant force, continuing to lead the market for two consecutive quarters. This reflects ongoing confidence among financial occupiers in long-term London submarkets, particularly in the City.

TMT & Creative Sectors

Previously major drivers of demand, saw a notable slowdown, now accounting for just 8% of activity. This could point to caution in the face of economic uncertainty or a temporary pause in large-scale leasing.

Professional Services

Saw a dip in activity compared to last quarter, despite typically being a stable contributor to demand.

IT & Real Estate

Both industries made strong showings last quarter. This may signal a rebound in advisory, infrastructure, and built environment firms committing to new or upgraded space.

A wide mix of “other” sectors (20%) underlines a broadening of occupier profiles, including growing interest from healthcare, education, and third-sector organisations.

Sectors We Found Offices For in Q1

SHB Deal Data

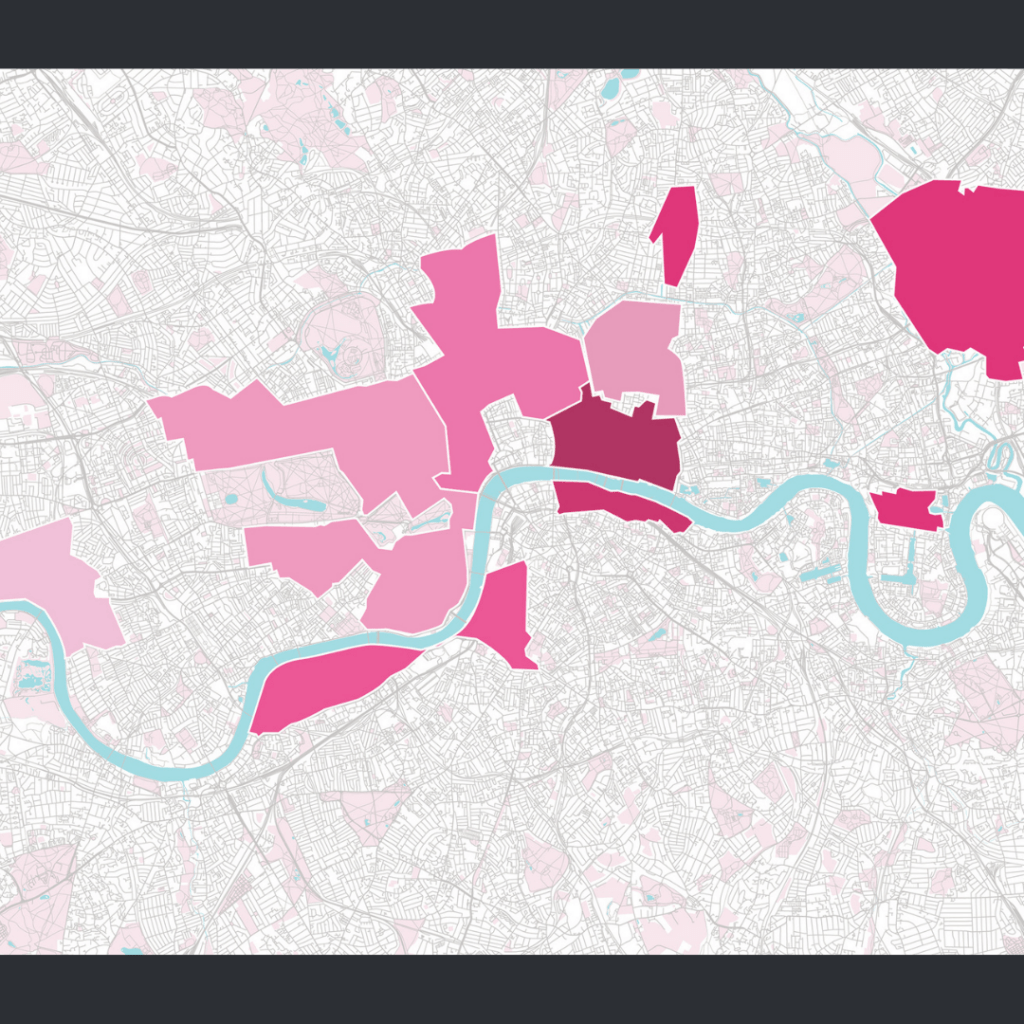

London Office Market Snapshot

We ran the numbers, followed market activity and spoke to a LOT of businesses. Here is what we saw…

Total take-up across Central London averaged around 2.34M SqFt, reportedly up to 25% below the 10-year quarterly average.

Vacancy rates crept up slightly, sitting around 9.3%, driven largely by second-hand stock entering the market.

Prime rents remained resilient or rose in top submarkets like the West End and City, with headline figures reaching new heights.

Q1 2025 London Office Rent Trends

Rent Trends By Submarket

West End Core

Mayfair, St James’s

Headline rents in the West End Core are now reaching up to £158.50 psf for select premium floors, with broader averages ranging between £140 – £158.50 psf, reaffirming the area’s status as London’s top-performing submarket.

📈 New highs in Mayfair, Soho, Regent Street and Knightsbridge

City Core

City of London, Clerkenwell, Farringdon

Prime space in the City is achieving up to £91.50 psf, reflecting a strong occupier focus on new build and high-spec refurbishments. Rents range from £45 – £91.50 psf depending on building quality and location.

📈 Up ~11% YoY in core towers

Southbank

Waterloo, Southwark, London Bridge

Rents here range from £72.50 – £77.50 psf on average, with highs approaching £98.50 psf for exceptional buildings. A favourite among media, tech and AI sectors.

📈 Demand accelerating for Grade A and ESG-focused stock

East London

Shoreditch, Stratford, Dalston

Rental growth is steady, with typical ranges from £65 – £75 psf in the Northern City Fringe and £49.50 – £60 psf in Stratford and Dalston.

📈 Tech and creative sectors driving resilience

Canary Wharf & Docklands

Prime Docklands rents currently range between £55 – £60 psf, with broader stock from £45 – £60 psf. The market remains relatively flat amid ongoing structural shifts.

➖ Tenant-favoured market conditions persist

Midtown

Holborn, Bloomsbury, King’s Cross

Prime rents here range from £80 – £85 psf, with peaks of £110 psf in King’s Cross and Covent Garden.

➖ Stable with moderate upward pressure in modernised assets

South West London

Vauxhall, Battersea, Hammersmith

Prime rents vary from £55 – £65 psf, reaching up to £80 psf in the best buildings. Demand remains steady, though more value-led than core markets.

➖ Holding steady as fringe markets attract cost-conscious occupiers

Key London Office Deals of Q1

| SqFt | Address | Occupier |

| 154,526 | Finsbury Circus, EC2 | Simmons & Simmons |

| 81,200 | 40 Grosvenor Pl, SW1 |

Cleveland Clinic |

| 72,412 | 1 Liverpool Street, EC2 | Knight Frank |

| 61,698 | Stonecutter Court, EC4 | Trainline |

| 47,783 | 40 Leadenhall St, EC3V | Huckletree |

| 40,933 | 76 Southbank, SE1 | PayPal |

Quarter Highlight

Last quarter saw the completion of our 2024-2025 projects for Lucid Group, working alongside the team to deliver projects in Marlow, Macclesfield, and their London HQ.

Our occupier advisory team oversaw the programme management, Landlord and Tenant work and acquisition management services whilst our building consultancy team helped oversee three dilapidations assessments and negotiations.

More to follow on this project as the team settle into their new 8,000 SqFt space in London’s Southbank but overall savings across the three sites are looking great.

How We Worked Together

- Programme Management

- Landlord and Tenant

- Acquisition Management

- Dilapidations Assessments and Negotiations

Looking ahead, we anticipate

Eyes on Managed

For companies in between workspace decisions, shorter leasing options with a single monthly rate will keep attracting attention.

Pent-Up Demand

Pent up demand may convert into transactions in H2, especially from occupiers who delayed decisions in recent years.

ESG = Critical Driver

Buildings with strong green credentials will continue to outperform both in terms of rental levels and take up. Location is key for decreasing footprint and increasing employee wellbeing.

Quality Space

This trend is just getting started for occupier strategies, with strong demand for Grade A, ESG-certified space.

Q1 2025 has set the tone for a cautious market, but one that needs to rethink workspace and policies for getting teams together. There is a clear branch off in demand between best-in-class space and everything else. The coming quarters are likely to see a more balanced return to activity across sectors as occupiers re-engage with the market and London companies continue to reverse remote working strategies.